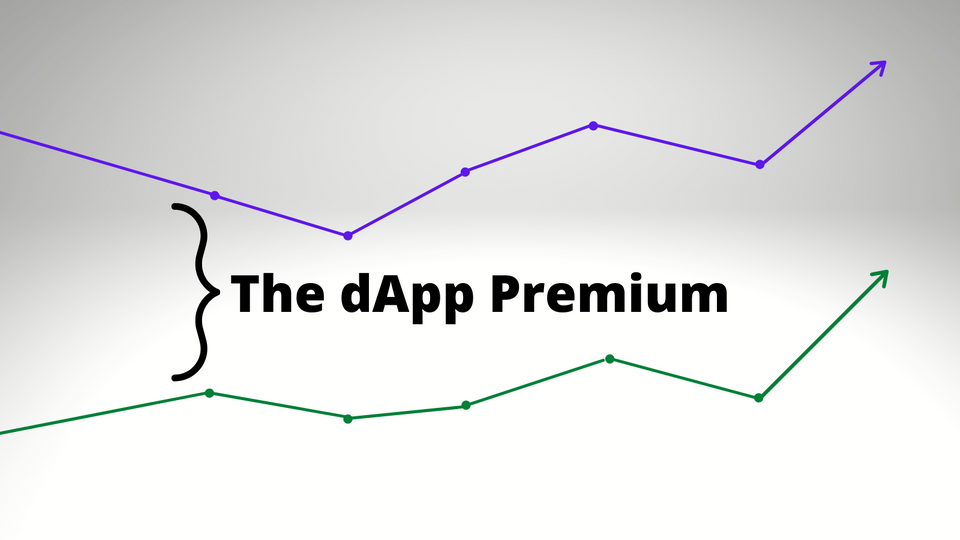

The dApp Premium

This article explains a cool way you can exploit the differences in rates between traditional finance and DeFi to make (nearly) risk-free returns. With this post I explore the dichotomy between the smart contract-based (DeFi) risk-free rate and traditional rates because I think it's really neat - more importantly, like a nerd of old, I wanted to coin the term: the dApp Premium. This post starts with some background on the risk-free rate and why it matters and then transitions into defining and illustrating the dApp Premium - or crypto nerd premium, whichever you prefer.

Free money sounds nice, but what's a rate? Is this another multi-level marketing scheme?

One of the most important inputs to global financial, economic, and case-based models is the market interest rate. A market interest rate simply answers the question: for the market in question, what is the cost of money? If I want to borrow funds, how much will I have to pay in interest?

These questions are important because their answers lay the groundwork for financial analysis - the exercise of determining the risk/return profile of something you do with money. For example, if I wanted to understand the profitability of a local, upstart halal cart, I would first need to understand expected costs and revenues from the operation. Assuming the entrepreneurial chef does not have enough funds to launch the business outright, they would have to borrow money at some premium to (wait for it) market rates. The interest the business has to pay at market rates will have an impact on how we view the profitability of the startup (do halal carts count as startups?).

In the real world, this rate is often quoted as a number that everyone agrees is a good baseline number for the headlines. In reality, there are lots of interest rates that can apply to any given situation based on the term, collateral, risk, warrants, etc. of the loan. The number that talking heads bring up on CNBC is the most common rate because it is an easy floor for all rates: the risk-free rate. For most of financial history (i.e. last ~80 years), the rate used for the risk-free rate is the US Treasury Bond Rate: how much it costs the US government to borrow money. This rate is considered risk-free because the US government can always pay its debts by printing more money, raising taxes, and changing rates.

In DeFi, the risk-free rates are those on popular lending protocols with open-source smart contracts, audited code, over-collateralized debt positions, and functioning user interfaces - the rates are guaranteed by market conditions and code; the only way they are not risk-free is if the underlying network fails. Also, for the unfamiliar, the easiest way to interact with DeFi protocols is through their decentralized apps (dApps) - it's like Miniclip but for money.

Cool bro - rates are boring, where are you going with this?

I walked through this rather mundane explanation of the risk-free rate and why it's important because something interesting is happening in the (non-boring) world of decentralized finance. The rate of risk-free lending in smart contracts (DeFi) is way higher than the risk-free rate in the real world. Remember the first clickbait-y sentence of this post? If you can borrow risk-free at one rate in the traditional finance ecosystem and lend that money at a higher rate elsewhere, you can win the spread and execute what's called a "carry trade". But more importantly, you can only execute this trade if you understand how to use stable coins, dApps, and Web3 wallets - that's right, crypto nerds can make free money!

I'm all in - how does it work?

The dApp Premium (please let this catch on) exists due to the differences in real-world digital US dollars and blockchain-based digital dollars, for this article I'll be focusing on the (best?) most secure and regulated option: USDC. In the real-world, your digital dollars sit in a database controlled by your bank and you see your bank balance whenever you quickly check your bank's mobile app to make sure you have enough fiat currency for the crypto purchase you sporadically made (could just be me). In DeFi, you see your digital dollars in your wallet represented as a token, in this case, USDC. There are more minor differences between these two types of digital dollars but all that matters is someone has stepped up to the plate to make sure they are exactly equal and redeemable 1:1.

So, in conclusion, there is an Ethereum-based dollar called USDC and the normal US dollar that we all know and love (which is basically digital - is cash still used for anything legal?) and they are effectively equal; moreover, they cost different things. As of writing, the current average (risk-free) lending rate in DeFi is ~11% and real-world lending rates globally (in traditional finance) are <1%. The easy trade to make is to borrow at the lower rate and lend that capital at the higher rate, all with the same underlying asset - the US dollar. The simple math that defines the dApp Premium is the variable lending (borrowing) rate in DeFi minus the variable borrowing (lending) rate someone can get in the traditional finance world - at a market level, average DeFi rates minus 1 Yr US Treasury Rates represent a telling dApp Premium (1 Yr UST chosen based on the shorter time horizon characteristic of a carry trade).

A wise man once said: when in doubt, lever up.

I find the dApp Premium to be very interesting because of what it represents: at its core, it represents a premium given to those investors who understand DeFi and can interact with it. Weirdly, this premium also represents a global source of alpha (market-beating returns) that is yet to be fully exploited because so few money managers are comfortable with, able to interact with, or aware of the peer-to-peer money markets in DeFi. Quite literally, outsized market returns (~10% dApp Premium at writing) are ripe for the taking at a massive scale because most investors do not know how to use dApps and/or aren't comfortable with it.

But Benjamin, it can't be that easy! Are you saying this is really risk-free? If what you're saying is true, why hasn't Wall Street figured this out?

It is important to note that executing the dApp Premium carry trade does come with some risks from both sides. For example, say I want to try my hand at making free digital money: I can borrow US dollars in a crypto-backed loan from BlockFi at 4.25% and I can lend those dollars out in DeFi (USDC) at 11%. After taking out the loan, I can use something like Coinbase to buy USDC with my real-world USD. Here I am going to eat a small transaction fee. With my funds now in Coinbase, I can then connect to one of the top lending markets via Coinbase Wallet (Coinbase, if you're reading this please accept me into your affiliates program) and stake my assets (Ethereum transaction fee) in order to start immediately accruing the market rate: 11%. The profit earned when closing out the trade after one year is equal to 10%*loan amount. Throughout this process, there are small chances that one of the trusted entities in this equation BlockFi, Coinbase, or the Ethereum network fails - these are third party risks which are minimal but non-zero in this example and must be considered in the context of the dApp Premium.

A massive assumption in the above money alchemy is that rates stay the same. This is the kicker: both traditional finance rates and DeFi rates are subject to change (supply and demand for money in both ecosystems drives rates). This carry trade should only be put on assuming that the dApp Premium is positive. Also, there are minor risks and hurdles that blur the lines of the dApp Premium trade: tax implications, third-party risk, credit score implications, etc. should all be accounted for.

The reason why there is generally one risk-free rate in traditional finance and another in DeFi is that within each ecosystem participants are doing this carry trade all the time. This makes rates converge in each ecosystem. The dApp Premium (is it a thing yet?) represents the yield that can be generated by understanding the differences between the two ecosystems and how to move capital between them. The mere existence of the dApp Premium signals that there is a provable lack of recognition, understanding, and utilization of DeFi markets.

As more people are comfortable with DeFi and the latency between moving digital dollars between the "real world" and DeFi trends to zero, the dApp Premium will also converge towards zero. When the dApp Premium consistently averages around zero, that will signal a transition into a new global financial system, one in which rates provided by smart contracts are just as utilized as those provided by banks. Until that day, I hope to explore the nascent ecosystem of DeFi and share my thoughts on this site. If you made it this far - thank you, I hope to iteratively improve my writing skills and post quality content here going forward.

Please note: everything in this article is strictly for educational and informational purposes only and does not constitute investment advice. Please read the Disclaimer that applies to this site and all content therein.